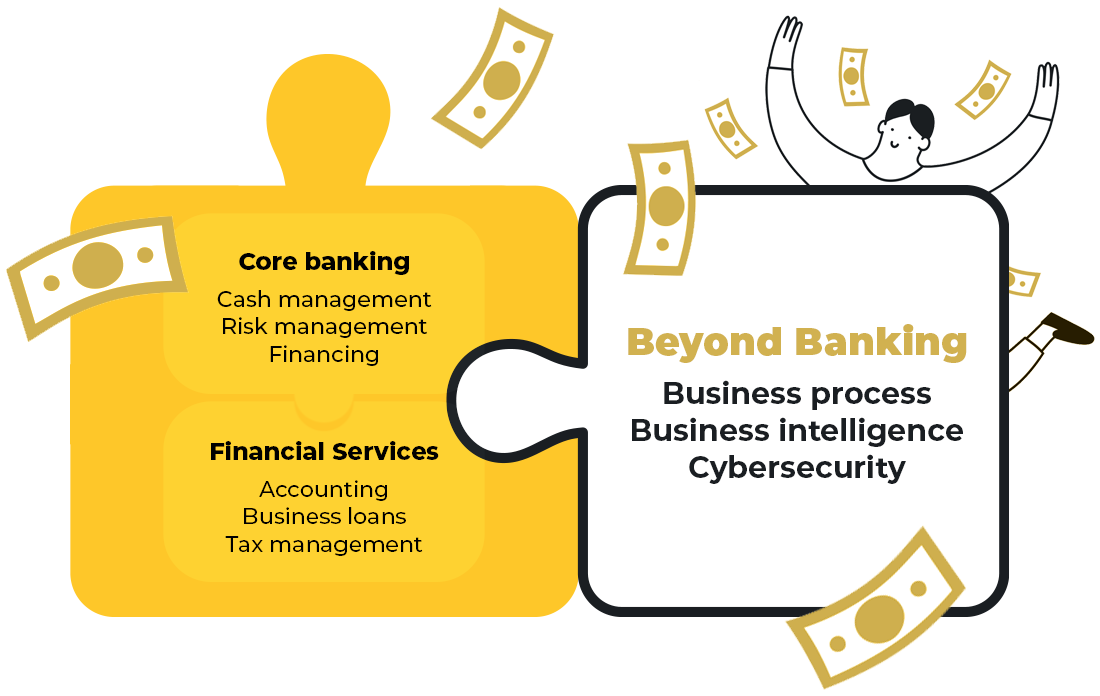

SME banking and fintech partnerships

Empower your SME clients beyond banking

Expand your SME portfolio with inTandem’s value-adding digital tools that support your small business clients in their business growth. Be the driving force of your SME clients’ success.