Over the last few years, as digitalization has taken hold, we’ve seen some fundamental shifts in financial services for small businesses. Fintechs and neobanks have managed to chip away at the market share and transactional volume that traditional financial institutions once held on to unchallenged.

Drawn to lower or zero fees, 24/7 transactions, and simpler, faster processes, businesses have flocked to “unbundled” finance, opting for these services whenever and wherever they’re needed.

While previously, entrepreneurs managed their lines of credit, investments and revenues with a specific banker at a specific branch, today they source finance products in a decentralized manner, depending on wherever they find the best rates, service and contextual convenience.

Why it’s time to rebundle

Traditionally, small business owners have been somewhat underserved by banks, treated as a subset of personal banking and lacking tailored business banking products. Viewing business customers through the prism of credit scores, as opposed to actual financial health or projected growth based on current business pipelines, banks limited themselves to a narrow perspective. But the line has been drawn.

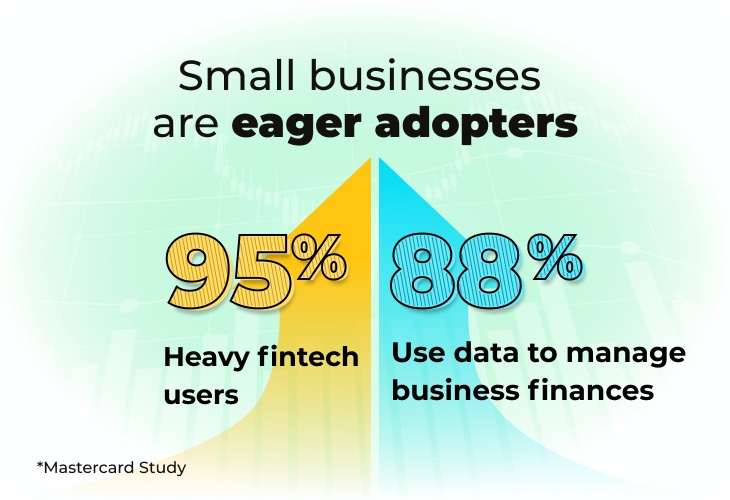

Today, it’s clear enough that businesses want digital, convenient, and customized financial services. According to recent research by Mastercard, small businesses are eager adopters of open banking and fintech services, with 95% considering themselves heavy fintech users and 88% using data to manage business finances.

But they don’t have all the services they require. Inflation is a top pain point, and they need allies to help them address it through improved financial management — and with better financing, with 85% looking for faster and easier access to capital.

This makes a lot of sense, given that in January 2023, big banks approved under 15% of the small business loan applications they received. Largely because of the friction — and rejection — involved with working with banks, small business owners are currently using a hodge-podge of fintechs, payment providers, neobanks, and more to access business services.

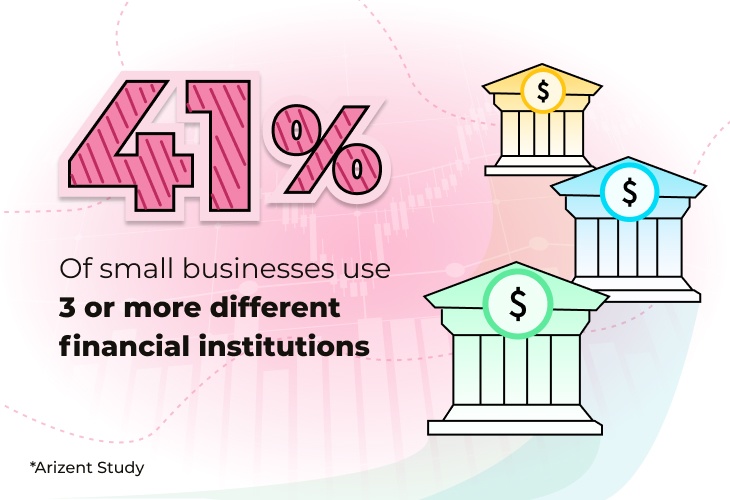

Arizent has found that nearly half of small businesses currently use PayPal, and a similar number favor online banks. Some 41% rely on three or more different financial institutions. This patchwork makes it harder to gain a cohesive and comprehensive view of their financial activity, plus it’s awkward to switch between platforms and providers. It’s time to bring these disparate services back together.

Banks are rebundling to provide payment processing, business checking, credit cards, payroll, and other small business services in a single location. Traditional banks that have yet to embrace open banking and fintech integrations need to partner up with third parties that can maximize customer data and enhance the services and CX they provide.

For these capabilities to be compelling to small business owners, they need to be easy to access and offered in the right contexts, as part of a platform that enables them to meet operational demands and hold on to — and expand — their share of the market.

It’s no longer a question of if or when to rebundle, but how. Here’s some food for thought on how to do it well.

Connect with partners to expand banking bundles

Small businesses tend to begin with four main business banking products — business checking, credit and debit cards, payroll processing, and payment card processing. But if that’s all you offer, you’re letting your business customers down. As businesses mature, they need products like accessible loans, cash flow management tools, billing via digital wallets, digital business banking, cyber and fraud resources, and finally trusted, personalized advice.

Being able to meet these demands is critical. When it comes to choosing a primary banking provider, digital tools are “critical” or “very important” to 81% of small business owners, according to the Areizent study, and 79% say the same about a wide range of banking products and services.

Banks need to connect with partners such as platform tech developers, fintechs and payment processing providers to be able deliver these services in a single location. This is the essence of rebundling; uniting all the diverse services that business customers need in a single context, so small business customers can access all their financial information and needs in one place.

Thought should be given to the nature of that context. For many banks, the default offering is a banking app, but you need to meet business owners where they actually spend their time — and where they feel safe giving many of their team members access. That might mean creating an integrated platform that businesses can depend on for their ongoing workflows.

Remove roadblocks to business banking engagement

All too often, business customers hit unnecessary friction in their regular banking tasks.

They should be able to open accounts, add credit cards, apply for business loans, and so forth entirely online, 24/7, and receive results within hours, not weeks. It’s possible in their personal lives, so why not for business activities?

But as Deloitte observes, most banks today have limited online capabilities. Such activities typically require in-person follow-up, and as bank branches close, these meetings are getting harder to schedule.

Banks can surmount this by linking up with fintechs to share their capabilities and offer smoother online banking experiences. It’s vital to remember that it’s not just about the products you offer, but the manner in which business customers can access them.

Put yourself in position to understand your business customer

Above all else, small business owners need personalized, data-based advice.

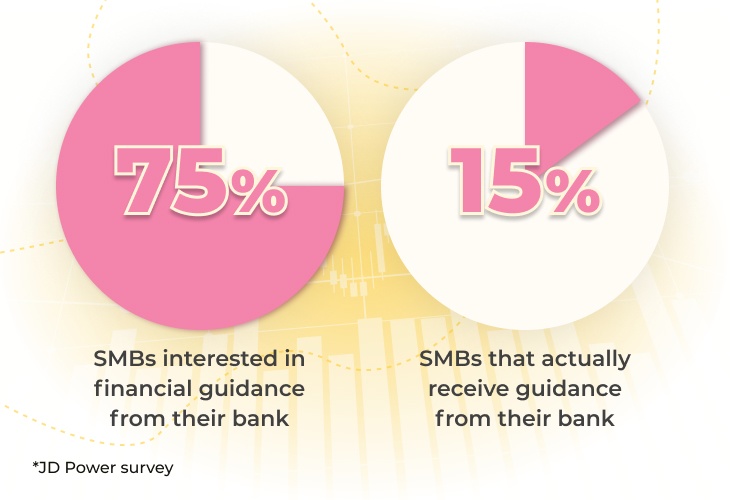

A JD Power survey found that over three-quarters of small business leaders are interested in financial guidance from their bank, but just 15% receive it. They want to talk with people who know their situation, but one-on-one relationships with bankers are hard to come by nowadays, depriving businesses of their trusted advisors.

Successfully offering advice in digital spaces requires connecting new types of data sources, upgrading analytics capabilities, and establishing pipelines that provide bank agents with relevant insights for their conversations. You need to unite the entirety of each customer’s financial data into a single repository to gain a holistic understanding of their financial past, present, and future, and this simply isn’t possible if your data is limited to bank app interactions.

Fintechs already rely heavily on “alternative” data, and could beat banks at digital engagement. Banks can compete, or partner with them as part of the rebundling process. With the right data and analytics, you can help business owners understand their financial standing now, deliver reliable predictions about future cash flow, and suggest ways to deal with it.

The final step involves applying these insights to automatically push the right financial product to the right business customer at the right time, like recommending a short-term loan to an ecommerce business to buy more inventory for the winter shopping season, or a high-interest business savings account to the company that just enjoyed a spike in billings.

Rebundling is at your door

With small business banking customers looking for more, banks are in a race to rebundle. By exploring partnerships with fintechs, online banks, and business finance platforms, banks can deliver the friction-free, customized banking experiences that small business owners need, deepening the value that they offer to small business customers.

As vcita’s VP Business Development & Product Partnerships, Amir Blich helps traditional financial institutions, fintechs, distributors and software vendors to join forces and create next-generation platform experiences that engage small business owners.

vcita partners with leading organizations that serve SMBs to propel forward a joint vision of empowering SMB digital transformation. To learn more, check out vcita’s partnership program.