It’s been frustrating for banks to see their small business customers trickle over to fintechs, neobanks, and alternative lenders. Thankfully, smarter use of alternative data sources could help traditional banks to stem the flow and rebuild relationships with small business owners.

Small business owners feel frustrated with banks and traditional lenders, who have generally taken a narrow view when assessing business loan applications, considering credit history, FICO scores, and just a few months of revenue. They frequently turn applications down if these figures are poor, even if the business has good prospects.

In January 2023, big banks approved just 14.4% of small business loan applications, but alternative lenders approved 27.8% — almost double the approval rate. This discrepancy leads small business owners to feel that banks don’t understand their needs or the realities they experience, so they move to financial institutions that respond more positively to their loan requests.

Banks don’t necessarily refuse small businesses because they are high risk, but because they don’t have the tools in place to assess that risk on an individualized basis. Their limited data access leaves gaps in the background of many small businesses. In contrast, fintechs and neo-lenders tap into alternative data sources, such as longer cash flow patterns and rent and utilities payments, gaining a richer picture of the small business applicant’s likelihood to repay loans.

Banks are struggling to join the alternative data revolution

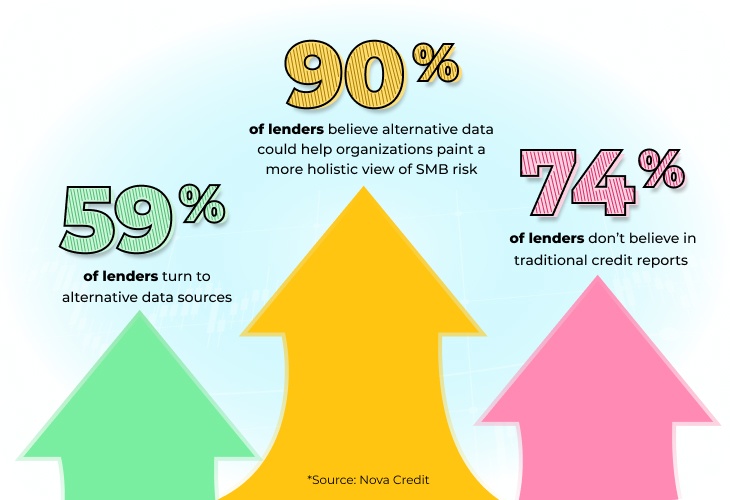

Banks have woken up to the need to join the open banking data revolution. Research by Nova Credit reveals that 74% of lenders believe traditional credit report data does not paint the complete picture of consumer credit worthiness. What’s more, 59% now turn to alternative data sources, and 90% believe that alternative data could help their organizations access new consumer segments or paint a more holistic view of applicants’ credit risk.

Banks have a big opportunity to regain small business trust, market share, and engagement, but only if they succeed in tapping into alternative data sources — which isn’t as easy as it might sound. The Nova report shows that many are struggling to draw on all the sources at their disposal, despite understanding the importance.

While 64% of lenders do look at non-transaction checking account data and 57% at cash flow data, fewer than 40% are making use of utility, rent payment and deep subprime data. Those using other data types like social media engagement, or looking beyond hard cash flow numbers at business history trends, is probably even lower.

This disconnect between intent and actualization is understandable, as working with alternative data can be challenging. There’s a risk that you’ll end up with fragmented, overlapping views that create confusion and uncertainty, as almost 50% of lenders cite reliability and/or stability of alternative data sources as a top concern.

And yet, it’s vital to integrate data sources the right way, so you can gain rich insights into a business’s past, present, and potential future. Banks need to bring all the data together to make fully informed decisions, taking the mindset of attaining a holistic picture, rather than replacing one dataset with another.

For example, if a small business has mediocre revenue deposit data but demonstrates growing social media popularity, it might tip the scales towards approval. While traditional financial institutions might see social media as a source of little more than novelty entertainment, its power for branding is enormous – the #smallbusinesscheck hashtag on TikTok alone has attracted over 19.5 billion views to date, and social media analysis tools can help make order of these signals.

Here are some pointers to help banks know where to look, what to look for, and what to do with the info they find.

1. Consider multi-year seasonality trends

Traditional bank loan approval decisions look at a limited slice of business revenue history, which might not present the full picture of the company’s potential.

For example, a sports training facility franchise that we’ve partnered with here at vcita recently applied for loans, so that the company could onboard more employees and fund marketing campaigns that would attract more customers and franchisees.

Their loan applications were refused, because the bank only considered the last three months of revenue, which were not impressive. However, this is because it was the middle of winter, when business is always slower. The owner knew that demand would pick up in the spring and summer, and if the banks had looked at a few years of revenue history, they would have seen that trend.

2. Assess more types of business activity

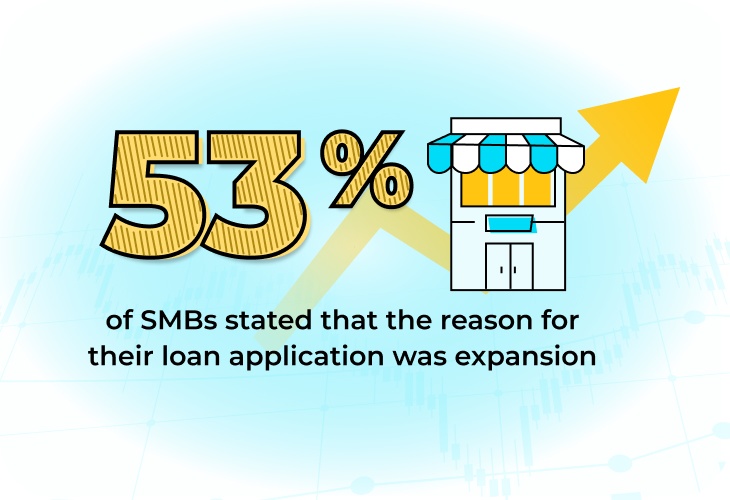

Banks need to ask searching questions, like whether the business is expanding, adding more employees, opening new branches, or developing new product/service lines, for example. The reason for requesting a loan could be significant, as a business looking to fund expansion is an altogether different flavor of repayment risk from one that can’t pay the rent.

The Small Business Credit Survey reported that 53% of businesses said that their reason for applying for credit in the past year was business expansion, making it the fastest-growing reason.

Banks need to look at trends like order volumes and profit and loss variations that reveal greater insight into a business’s likely ability to repay a loan.

3. Take a wider view of their funnel

In a similar vein, banks should look beyond invoices and receipts to examine the big picture of business trajectory. For example, there might be many sales which are already confirmed, but have not been paid for or invoiced. Today’s revenue may be flat, but if there are many scheduled appointments, requests for quotes, and logged orders, revenue is likely to spike within a known timeframe.

Lenders at banks may be nervous to rely on softer metrics like web traffic, conversions, and social media, but these can be valuable proxy indicators of the company’s potential for growth – as long as they are viewed in the context of broader business data, that is.

Social media engagement trends and online reviews can reveal how people feel about the company, and a business with enthusiastic ambassadors is more likely to grow. Brands have skyrocketed or plummeted because of their online reputations, which can be acquired overnight thanks to social media. For example, sales soar for books featured on BookTok.

With the right mindset, banks can use alternative data sources to retain small businesses

Banks that use alternative data sources in smart ways can overtake fintechs and regain their relationship with small business owners. Looking beyond credit scores and three months of revenue to seasonal patterns, wider business funnels, and other business activities can help banks better understand their small business customers. What’s vital is to approach these sources with a mindset of data integration, so that they complement existing insights rather than replacing them.

vcita partners with leading organizations that serve SMBs to propel forward a joint vision of empowering SMB digital transformation. To learn more, check out vcita’s partnership program.