Customer churn is a serious concern for large organizations serving small businesses. SMBs tend to be eager for SaaS tools that help them run their businesses more efficiently. As they scale, they’ll usually scale up their subscription to your solution as well, which means their long term customer lifetime value (CLTV) can be high. If you keep their loyalty, you could see increased revenue over time.

But SMBs are also highly concerned about RoI, so they can be quick to churn if they feel their needs aren’t being met. Every churned customer takes with them a chunk of your revenue. When customer churn rates are high, that means losing a significant percentage of your regular income.

It’s far easier and less costly to retain existing SMB customers than to attract new ones. High churn rates can damage your reputation, resulting in increased customer acquisition costs (CAC) and lower conversion rates in the long term. It also indicates customer dissatisfaction, which generally translates into less revenue. Furthermore, competition for small business clients is fierce, and losing them can result in missed upsell and cross-sell opportunities.

This article will help you learn to predict churn and prevent it before it even begins.

What is churn?

Customer churn means that your customer stops doing business with you. It could mean that they cancel their subscription to your SaaS solution or decide not to renew it, or that they stop buying a product that they used to purchase on a regular basis. It’s the flip side to customer retention: when retention is high, churn is low, and vice versa.

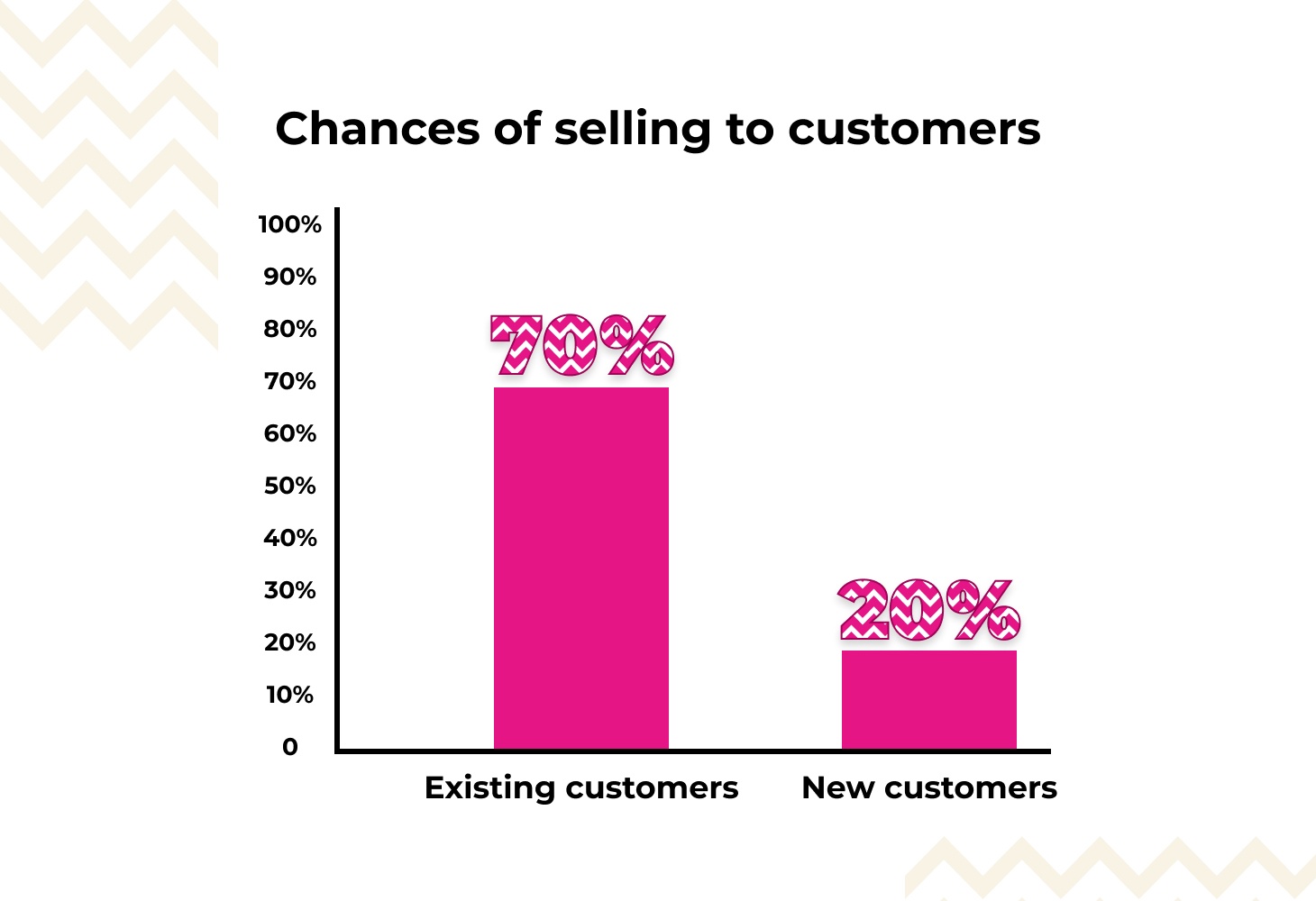

Unfortunately, churn is inevitable. You can’t hold onto every customer forever. But you can — and should — keep churn rates as low as possible. According to Bain & Co, increasing customer retention by just 5% can boost profits by anything from 25% to 95%. Another study found that you have a 60-70% chance of selling to an existing customer, but your chances of selling to a new prospect are only 20% at best.

When churn rates are high, it’s a sign that people are unhappy with some aspect of your company, whether it’s your product, your customer service, or your pricing, and that could result in even more churned customers. It’s important to take note as soon as churn rates start to tick upward, so that you can resolve whatever is causing the increase.

It’s also very important to understand what is driving churn. Even when churn rates are low, you need to know whether customers are leaving because they outgrew your solution, because economic trends meant they had to slash their budget and can no longer afford your product, or because they are dissatisfied with your solution. You’d take different actions depending on the reason behind the churn.

Constantly assessing and addressing the underlying drivers of churn helps you reduce friction within the solution and increase overall customer satisfaction. Last but not least, customer churn analysis helps you spot customers that are most likely to churn before they do so, so you can step in and prevent them from leaving.

Calculating customer churn

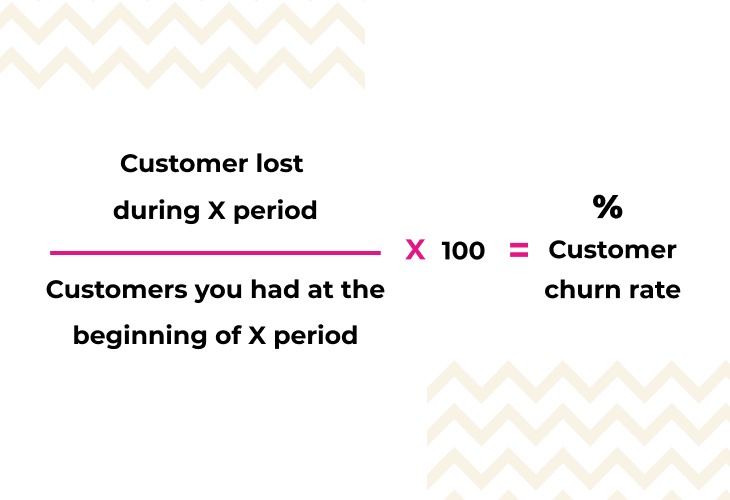

Having explained the need to track customer churn, let’s discuss the best way to do so. First, you need to understand the customer churn rate formula.

- Count how many customers churned during a specific period of time, like the last quarter.

- Check how many customers you had at the beginning of the quarter.

- Divide the number of churned customers by the number of customers you began with, and multiply the result by 100.

Here’s the process written out as a formula:

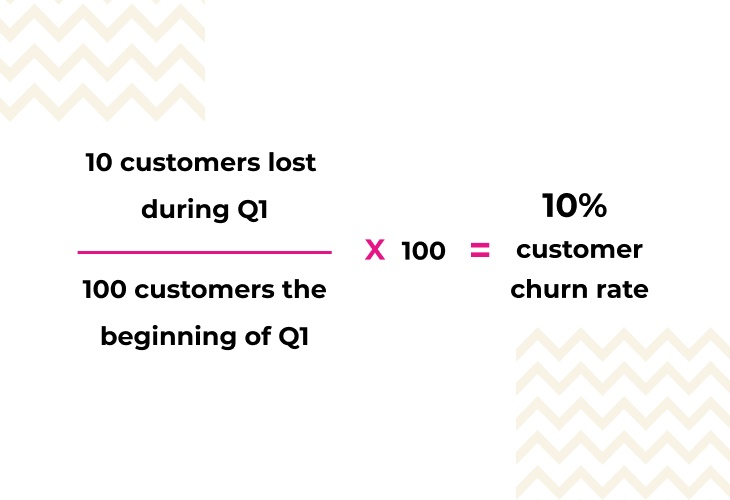

For example, if you began Q1 with 100 customers, and you lost 10 customers by the end of the quarter, your churn rate would be 10%.

As well as calculating your own churn rates, it’s a good idea to compare them against other companies in your vertical. For example, a 10% churn rate might be wonderful for a bank, dreadful for Netflix, and pretty good for a B2B company selling SMB business management solutions. You won’t be able to tell if your churn rate is excellent or awful unless you know what’s “normal” for similar companies in your industry.

According to recent research, typical churn rates for SaaS companies are around 13%. It’s far less than for finance companies, where rates hover around 25%, but a lot higher than for digital media companies, which have average rates of 6%.

The Power of Predictive Analytics

While it’s important to know how many customers have already churned, it’s even more important to know in advance who is most likely to churn. This is called churn prediction, and the best way to carry it out is to use predictive analytics for customer churn analysis. These are tools that apply machine learning (ML) to analyze customer behavior, how customers interact with your product, and how they connect (or otherwise) with customer-facing employees.

It’s impossible to carry out this kind of predictive analytics manually, because there’s too much data for a human to spot patterns. But machine learning can quickly crunch the data and spot trends that indicate that a customer is frustrated, unhappy with your solution, or isn’t using it as much as they used to (which is referred to as “low adoption”).

Customer churn prediction is a superpower that gives you X-ray vision into customers’ concerns. This way, you’ll be able to step in quickly with customized engagement strategies that resolve whatever was driving a customer to churn. You can prevent them from leaving and even strengthen their loyalty. For example, if you know that 90% of customers who forget to renew their subscription end up churning, you can send an email 2 weeks before their renewal date, with special offers for existing customers.

Data-driven approaches like predictive analytics provide businesses with valuable insights into the reasons behind churn. These insights help companies to make informed data-driven decisions to improve their products, services, or customer experiences in ways that strengthen customer relationships. Instead of applying retention strategies to everybody, businesses can focus on the most valuable customer accounts, which reduces marketing and operational costs while delivering a higher return on investment.

With predictive analytics, businesses can also segment their customer base into different categories based on their likelihood of churning, and tailor different offers and marketing messaging to each group. For example, high-risk customers might receive personalized retention offers, while more upsell or cross-sell opportunities could be sent to low-risk customers.

Last but not least, using predictive analytics to understand customer churn gives businesses a significant competitive advantage. Businesses that can predict and mitigate churn effectively will proactively resolve areas of friction which not only lead to churn, but also affect customer satisfaction. This helps them to retain customers, increase customer lifetime value, and ultimately outperform their competitors. In industries where competition is intense, this can be a significant differentiating factor.

Building churn prediction models

Using predictive analytics to understand and forecast customer churn requires building a machine learning churn prediction model. This involves a number of different steps:

- Data collection. You need to gather relevant customer data, such as demographics, transaction history, usage patterns, and customer interactions, and store it in a single data repository that your churn prediction model can access.

- Data preprocessing. Before you can use the data to train an ML model, you need to clean and prepare it. This can involve adding missing values, noting outliers, and encoding categorical variables. Normalize or scale features as needed.

- Feature selection. Identify the most important features that influence churn, using techniques like feature ranking, correlation analysis, or domain knowledge. The idea is to identify which features are the most valuable in accurately predicting customer churn, while reducing noise and computational complexity.

- Feature engineering. You might need to create new features or adjust existing ones, provide the model with more informative attributes that improve model performance. This involves extracting, transforming, and deriving new information from the available data, to enhance the quality of the features.

- Model selection. Choose the most appropriate machine learning or statistical model for churn prediction. There are many different ML models that can be used for customer churn analysis, including logistic regression, decision trees, random forests, and neural networks.

- Model training. Once you’ve selected which model to use, you need to train it with the training data you preprocessed. You’ll use the features as predictors and the churn outcome as the target variable.

- Model evaluation. Assess model performance using metrics like accuracy, precision, recall, F1-score, and ROC AUC. You’ll have to tune the hyperparameters that govern the model in order to optimize performance.

- Applying the model. It’s time to use your trained model to predict customer churn, either using your test dataset or on real-time data. Analyze the model’s outputs to understand the factors contributing to churn and identify actionable insights.

- Model deployment. Once you’re happy with the model’s performance, you can integrate it into your systems or processes, for continuous monitoring and proactive churn management.

- Model monitoring and maintenance. The process isn’t over; you need to regularly reevaluate and update the model as new data becomes available. This way, you’ll ensure it remains accurate and relevant for ongoing churn prediction.

You don’t need to reinvent the wheel — there are many churn prediction models already out there that successfully predict customer churn and deliver valuable insights. For example, logistic regression is a popular churn prediction model because it’s straightforward and interpretable. It’s suitable for situations where the relationship between predictor variables and the probability of churn is assumed to be linear.

Many companies choose some version of decision trees, which applies a tree-like structure that can predict churn based on feature values. Decision trees are intuitive and easy to interpret. You can also use Random Forest, which combines multiple decision trees to improve predictive accuracy and reduce overfitting.

Another option is called Support Vector Machines (SVM). SVM is effective in separating two classes, making it suitable for binary classification problems like churn prediction. It can handle complex decision boundaries and works well when there is a clear margin between churn and non-churn cases.

Building a churn prediction model is an iterative process that requires ongoing monitoring and adaptation to changes in customer behavior and market dynamics. You’ll need to constantly adjust data, tweak your model and model parameters, and allow for fluctuations in market trends and customer expectations.

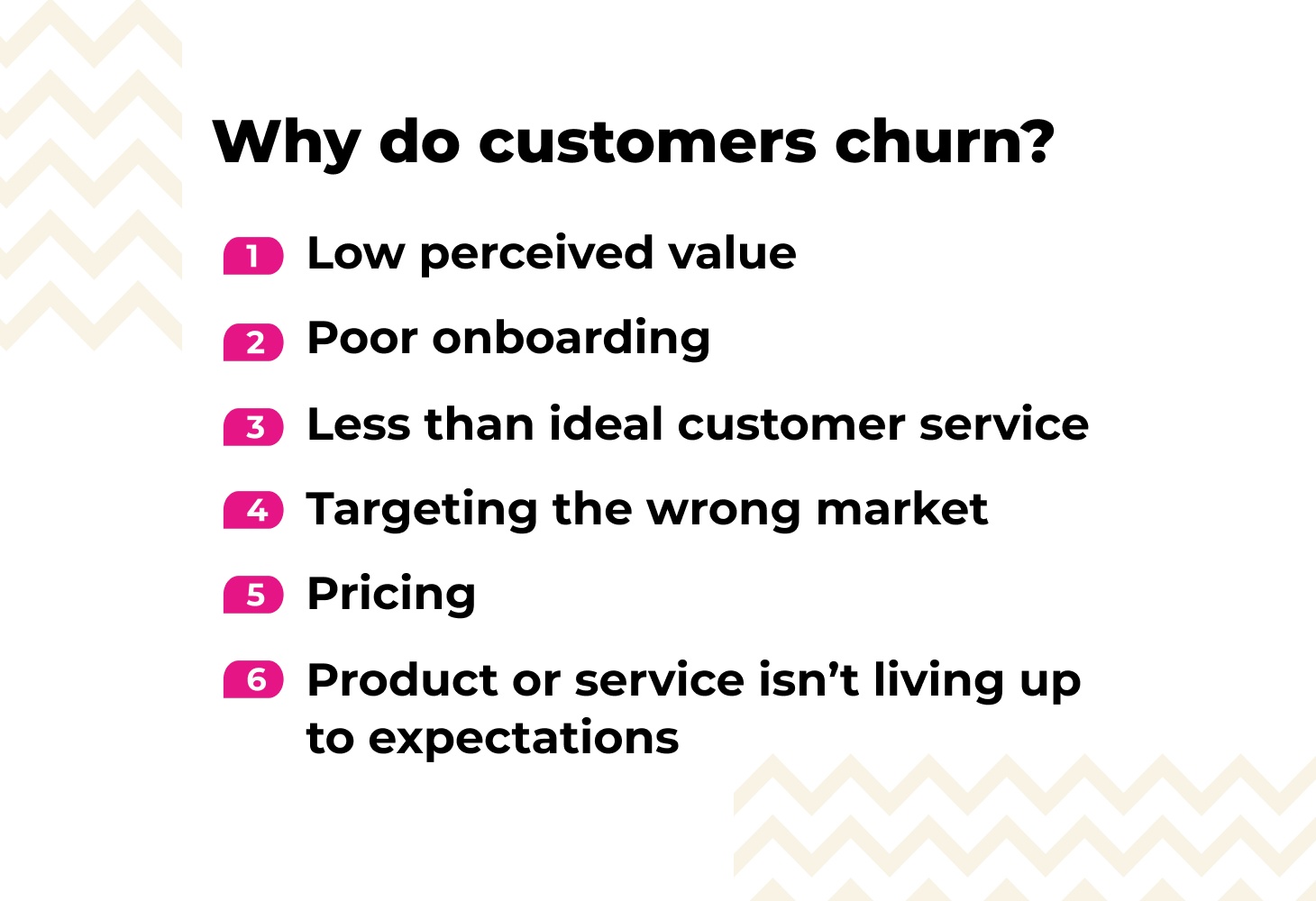

Why customers churn

There are a number of factors that can cause customers to churn, and often customers are affected by more than one of them. Here are some of the most common reasons for customer churn.

Low perceived value

If SMB customers feel that the cost of the product outweighs the benefits that they expected, they’ll consider that they aren’t receiving the value they wanted. This makes them easy targets for your competition.

Poor onboarding

Your solution might be perfect for your customer’s needs, but the customer might never discover this if your onboarding process is inadequate. Poor onboarding can result in customers who overlook valuable features and benefits in your product, or who find it too difficult to get started. This leads to high churn early in the customer lifecycle.

Less than ideal customer service

Customer experience is everything. Often it takes just one negative interaction for someone to decide to switch to a different company. SMB customers who have trouble getting through to helpful, friendly, and knowledgeable support agents are more likely to churn.

Targeting the wrong market

Sometimes churn results from a bad fit between your solution and your audience. This can happen particularly with paid advertising. If your marketing targeting isn’t spot on, you could end up converting SMB owners who don’t really need your solution and churn as soon as they realize it, while other ideal customers go unnoticed.

Pricing

The bottom line can be a major concern, especially for small businesses with limited budgets. Sometimes customers appreciate your solution but genuinely can’t afford it, in which case a special offer can be all that’s needed. At other times, customers feel they are paying more than the solution is worth, in which case you might need to improve your onboarding (as mentioned above) to make sure they’re tapping into all the benefits.

Product or service isn’t living up to expectations

Your SMB customers bought your product because they had specific expectations about what they’d receive. Those expectations may or may not be reasonable, so it’s important to drill down to check whether you need to improve your product, or perhaps you’re targeting the wrong crowd who are arriving with impossible expectations.

Start predicting churn before it happens

Customer churn is a highly important metric for organizations that serve SMB clients. High churn rates can indicate an underlying issue with your solution or customer service, and if left unaddressed, can harm your bottom line.

Fortunately, it’s relatively easy to carry out customer churn prediction and analysis. Today’s advanced predictive analytics tools use machine learning to empower companies to predict who is most likely to churn. With the help of churn prediction analytics, you can gain a better understanding of the issues that most concern your customers, and zero in on the top drivers of customer churn.

Effective churn prediction and mitigation makes it possible for organizations to slash churn rates while also increasing customer satisfaction, maintaining a competitive edge, and strengthening customer loyalty.