It’s no secret that digital tools help small and medium-sized enterprises (SMEs) in their growth journeys. One might even say that at the heart of every successful small business lies a comprehensive ecosystem of tools, insights, and partners, such as Mastercard and vcita, who support this success.

In this exclusive Q&A, we sit down with Tom Fitzpatrick, Vice President of Global SME Commercialisation at Mastercard, to discuss how one of the world’s leading payment technology companies is reimagining “empowerment” for SMEs through innovation and collaboration with tech companies like vcita.

From his fascinating journey as an Olympic sailor to a fintech leader spearheading global transformations, Tom shares his perspective on what SMEs truly need to succeed today, and how Biz360, Mastercard’s new one-stop shop SME solution, plays a pivotal role in that vision.

Tell us a bit about your background and your journey that led to your current role at Mastercard.

I’ve led commercial teams at fintechs, both large and small, since 2007 from a scale up building AI agents for automating AML and KYC to complex core banking transformations that replaced multiple legacy monolithic platforms with one modern platform to trading, treasury and risk systems. Prior to that I was a professional sailor on the Irish Olympic team for many years until competing in the 2004 Olympic Games in Athens, which was an ambition of mine since I was 11 years old.

Many leaders talk about making a difference. What does “making an impact” mean to Mastercard when it comes to SMEs?

According to the World Trade Organization, small businesses make up 90% of companies globally, create over 60-70% of jobs, and contribute 50% of GDP. At Mastercard, we know that when small businesses win, everyone wins. The Mastercard team is committed to building technology specifically for small businesses to more efficiently manage their daily operations, allowing them to focus on what they do best – grow their business.

By combining Mastercard’s value-added services and its innovative payments, we’re helping financial institutions strengthen their small businesses product offering. In many cases small business owners will use their consumer accounts to manage their business banking – and we’re enticing those businesses to transition over to a more fit-for-purpose product where they start generating a credit history. Loan rejection rates can be significant in many countries so by better serving this segment we achieve one of our strategic objectives of helping small businesses gain access to capital.

We are in a strong position to distribute small business software globally through our network of issuing & acquiring partners, and are focused on moving the needle to help small businesses become more efficient, profitable, more easily access funding so they can grow faster and make an impact in their communities.

Mastercard is an inspiring leader in empowering SMEs. How did that journey begin?

The small business segment makes up¹ 50% of B2B flows globally and we saw a major opportunity to capture high-value payment activity, which was previously dominated by EFTs, cash, and checks, as the pandemic accelerated the shift to digital operations and online payments. When we looked at small business banking it was clear that there‘s immense potential to match the experience of personal banking. Enhancing financial institutions’ small business offerings by bundling software, designed for everyone from gig workers to companies with up to 50 employees, was a natural next step.

What does “empowering SMEs” really mean to Mastercard? What are some of the challenges SMEs face that big players like Mastercard can help solve?

At Mastercard, “empowering SMEs” means recognizing that no small business exists in a vacuum. Each one is part of a broader community – whether it’s a pastry maker in Delhi or an auto parts manufacturer in Dayton – and contributes something unique to how people live, work, and connect. We understand that when small businesses thrive, communities thrive.

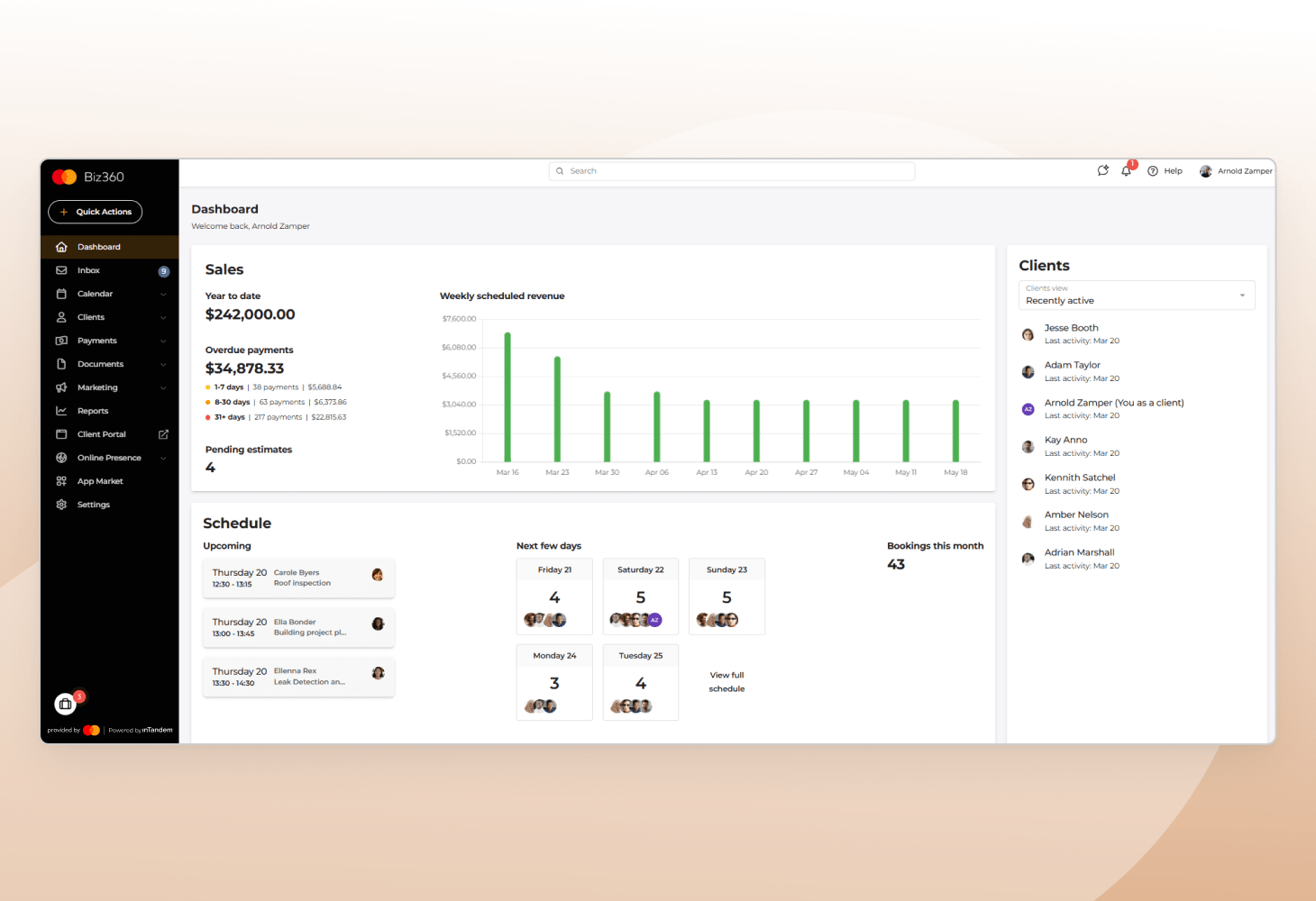

That’s why we’re focused on solving the operational and financial challenges that small and medium-sized businesses face every day. Operationally, this means equipping them with digital tools, like Biz360, that help them run more efficiently, attract new customers, and make smarter decisions. Financially, it’s about helping them manage cash flow, streamline payments, and access capital more easily.

But empowerment goes beyond tools. Through our trusted network of community leaders, banks, technology partners like vcita, and merchants, we’re creating inclusive programs and scalable solutions that meet business owners wherever they are on their journey. From initiatives like Mastercard Strive and Digital Doors to all-in-one platforms like Biz360, we’re helping small businesses go digital, grow their networks, and unlock new opportunities.

Ultimately, we’re committed to fueling the growth of small businesses because we know that the stronger the small business, the stronger the community.

Mastercard is famous for building successful relationships with innovative tech partners. Can you explain Mastercard’s collaboration with vcita, for those who haven’t heard of Biz360?

We found an innovative partner in vcita, a vendor with a proven, mature product, already in use by over 150,000 small businesses.

The Biz360 platform continues to evolve, occupying a unique position in the marketplace between the dominating accounting software vendors and some ‘all in one’ small business platforms.

vcita very quickly proved that they are able to “Move Fast”, a core tenant here at Mastercard, ensuring we could trust their ability to deliver software at scale and as rapidly as possible.

How does vcita complement Mastercard’s ecosystem of SME tools, data, and infrastructure?

vcita complements Mastercard’s SME ecosystem by integrating seamlessly into our growing technology stack, which is purpose-built to deliver small business-specific functionality. Combined with vcita’s innovative technology, Mastercard is scaling-up heavily behind the scenes to enable capabilities and bring new innovations to market to address SMEs’ biggest needs. Together, this creates a scalable foundation that combines software, data, and embedded financial tools to support SMEs at every stage of growth.

What’s your experience been like working with vcita so far and what role do you believe this collaboration will play in SME success?

What stands out most is vcita’s reliability and commitment. They’ve consistently gone above and beyond to ensure Biz360 is successful and a collaborative effort. It’s clear they’re as invested in our success as we are.

In terms of their impact: time is the greatest commodity for any small business owner, and Biz360 helps them reclaim it by simplifying day-to-day operations, surfacing actionable insights, and reducing the friction of managing finances, customers, and growth, all in one place. Every financial institution that offers Biz360 to their small business customers gains a powerful differentiator by delivering value-added services that reach the heart of their SME clients’ needs: saving time.

Winning a business account often means winning the founder’s personal account too, creating a “two-for-one” opportunity. For existing customers that use the platform, they become far more loyal and more profitable. For example, a 10-person business can replace multiple other digital tools with streamlined, cost-effective solutions like Biz360. And for new businesses that haven’t yet adopted CRM, marketing automation, invoicing, or scheduling tools, receiving all of that functionality free from their bank is a highly compelling value proposition.

What do you believe the future of running a small business will look like 5 years from now and how will collaborations like this one help shape it?

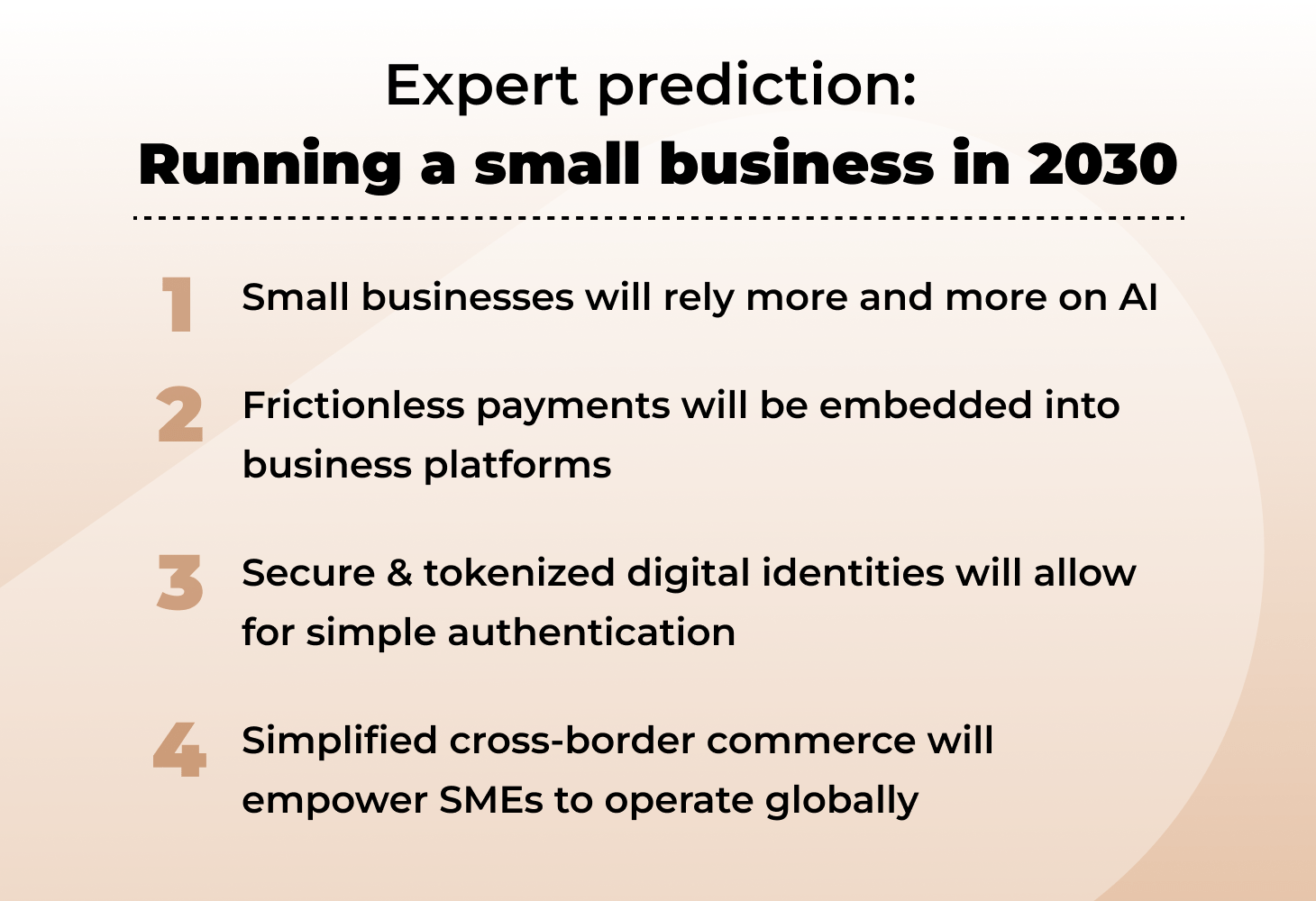

Running a small business in 2030 will be shaped by deep digital integration, AI-driven automation, and seamless financial ecosystems. Mastercard, in collaboration with vcita,could play a pivotal role in this transformation. Here’s how:

- Small businesses will increasingly rely on AI automation for tasks like inventory management, customer service, marketing automation, and financial forecasting.

- Payments will become frictionless and embedded directly into business platforms. Think of invoices that auto-pay or POS systems that integrate with accounting and tax tools in real time.

- Secure, tokenized digital identities will allow small businesses to authenticate across platforms.

- Cross-border commerce will be simplified through interoperable payment systems, enabling even micro-businesses to operate globally.

Mastercard and vcita’s collaboration is poised to unlock powerful synergies, and we continue to look for new ways to innovate across integrated financial management, AI-driven insights, contextual credit solutions, and global growth enablement.

What does the next frontier of SME financial services look like and where does Mastercard want to lead?

The next frontier of small and medium business financial services is being shaped by AI-driven personalization, embedded finance, cybersecurity, and global scalability, and Mastercard is positioning itself to lead in each of these areas.

- Financial services will be built directly into SME platforms. Think invoicing tools that offer instant financing or POS systems that auto-reconcile with accounting software.

- Mastercard is doubling down on new payment flows like B2B accounts payable/receivable, virtual cards, and non-carded bill payments.

- As SMEs digitize, they become more vulnerable to fraud. Mastercard is taking on cybersecurity through acquisitions like Recorded Future, which enhances threat intelligence and fraud prevention.

- The rise of AI agents making autonomous purchases on behalf of businesses will require new trust and verification layers.

- SMEs will increasingly operate across borders. Mastercard’s real-time payments and tokenization infrastructure will support seamless, secure global transactions.

With AI on the rise, it’s hard to get away from the topic. How do you see AI playing a role in SME operations moving forward? How is Mastercard propelling AI adoption among this sector?

AI is rapidly becoming a cornerstone of small business operations, and its role will only grow in the years ahead. From automating inventory management and customer service to streamlining marketing and financial forecasting, AI is helping SMEs operate more efficiently and make smarter decisions with fewer resources.

At Mastercard, we’re committed to making these capabilities accessible to entrepreneurs everywhere. That’s why we launched the Small Business AI tool – an inclusive tool that delivers customized assistance for small business owners, anytime, anywhere, as they navigate their unique and varied business hurdles. Through a conversational chatbot interface, it delivers tailored guidance on topics like digitizing operations, accessing grants, improving financial literacy, and negotiating brand partnerships. With insights customized for industries ranging from content creation to childcare and food trucks, it helps cut through the noise and empowers SMEs to act with confidence.

By embedding AI into practical, easy-to-use tools, Mastercard is helping small businesses not just keep up, but also lead in a digital-first economy.

If Mastercard could get the industry truly passionate about one initiative to support SMEs in the next 1-3 years, what would it be and who would need to join the table?

One of the most impactful steps we can take is to make it easier for small businesses to get paid—quickly, securely, and in ways that work for them. That starts with improving how invoice payments flow through the ecosystem. By focusing on digitizing and embedding payments into the platforms SMEs already use, we can help them unlock working capital, reduce friction, and operate more efficiently from day one.

We see real value in building on what’s already creating impact for small business owners. That could include:

- Streamlined digital onboarding for faster access to Mastercard-backed payment tools, including identity and KYC verification.

- Embedded financial services that meet SMEs where they are

- Built-in security through Mastercard’s fraud detection and tokenization, helping SMEs transact with confidence.

To move this forward, we’d look to deepen our work with fintechs, neobanks, and platform partners like vcita—those who are already embedded in SME workflows. Mastercard’s role is to provide the infrastructure that makes it all work: payments, identity, and trust.

This isn’t about reinventing the wheel, it’s about squeezing more juice out of the orange. By focusing on invoice payments and embedded services, we can differentiate our value proposition, support alternative distribution, and drive greater acceptance, all while helping small businesses thrive.

What advice would you give to financial institutions that want to better serve SMEs but aren’t sure how to do so meaningfully?

The competitive landscape for serving small and medium-sized businesses has shifted dramatically. Challenger banks and non-bank platforms offering embedded finance are gaining ground by delivering tailored, holistic solutions to niche SME segments.

Financial institutions who adapt and evolve alongside their SME customers’ needs have a real competitive advantage. In addition, our research tells us that 45% of SMEs² feel that their business banking online experience is not as good as their personal banking experience. This insight points to a clear opportunity: SMEs are looking for more than just a bank. They want a partner that understands their unique needs. The path forward is clear: meaningful service starts with understanding the real pain points of SMEs and designing solutions that meet them where they are – digitally, operationally, and financially.

¹https://fitsmallbusiness.com/b2b-payment-statistics/