With fierce market competition, service commoditization, pricing pressure, and weak brand loyalty, it’s a challenging time for telcos looking to grow in the SMB market. The market is saturated with similar offerings from various players, leading to deteriorating margins and high churn rates as customers easily switch providers for minimal cost savings.

Significant investments in network infrastructure are largely benefitting broad markets and enterprise use cases, often overlooking the diverse needs of the SMB segment. And while the rise of SaaS marketplaces provided telcos with a platform to expand their service offerings with minimal sales efforts, it didn’t solve the challenge of low margins and weak brand loyalty, as customers could purchase most of these services from other vendors.

To unlock growth potential and forge deeper customer relationships, telcos must look beyond traditional approaches and address the unique demands of the underserved SMB market with tailored, value-added solutions that truly meet SMB needs. SMBs are the backbone of our economy, representing over 90% of all firms globally and contributing up to 70% of global GDP. Yet, they often remain underserved and overlooked by telcos who favor larger, seemingly more manageable enterprises. This approach leaves a massive market opportunity on the table—one that is ripe for innovation and growth.

SMBs face unique challenges: they’re highly vulnerable (nearly 40% of new American businesses fail in the first three years), and in many cases, they lack dedicated IT resources, and unlike enterprises their needs are so diverse that they cannot be condensed into a few use cases. These hurdles often result in high churn rates. However, with the right strategy, telcos can transform these challenges into opportunities for growth and deeper engagement.

In this article, I will outline the specific challenges that telcos face with the SMB segment and how leveraging operational data and innovative solutions can position them as trusted advisors to SMBs. By doing so, telcos can not only unlock new revenue streams but also build lasting relationships with a critical segment of the market while leveraging and strengthening their brand.

The importance of focusing on the SMB market

SMBs are increasingly adopting digital tools to stay competitive. According to Localogy’s 2024 Modern Commerce Monitor™ State of SMB research report, 90% of SMBs use digital services or tools to manage a critical business process, making them an attractive segment for telcos. With the right support, these businesses can significantly benefit from tailored IT and communication solutions. In fact, last year’s USD 66 billion global SMB spend on telco-delivered solutions (excluding communications) is planned to grow at an annual rate of 6%-8% through 2028. This indicates a growing demand for advanced, reliable, and scalable services that telcos are well-positioned to provide.

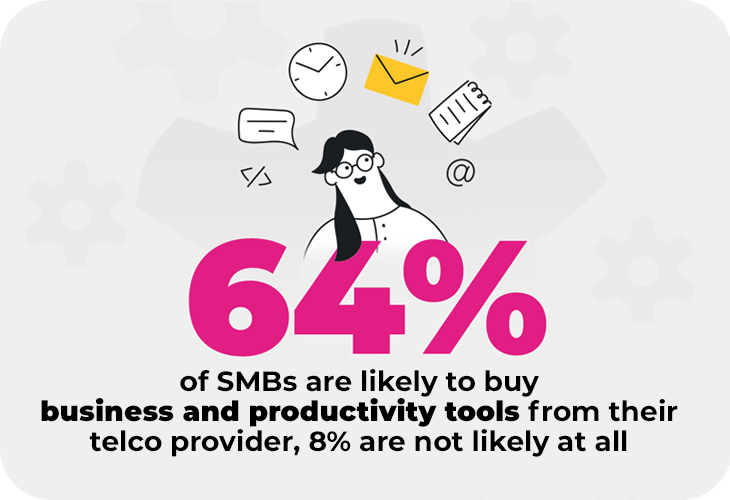

Moreover, SMBs are looking for partners who understand their unique challenges and can offer comprehensive support. According to a recent vcita survey, 64% of SMBs are likely to buy business and productivity tools/services from their telco provider, and only 8% are not likely to at all. This trust presents a unique opportunity for telcos to deepen their engagement with SMBs, offering not just connectivity but also value-added services that drive growth and efficiency.

Focusing on the SMB market also aligns with the need for telcos to innovate beyond traditional connectivity services. By offering solutions such as cybersecurity, hosted applications, and business management platforms, telcos can position themselves as essential partners in SMBs’ digital transformation journeys. This approach not only helps capture a larger share of the SMB market but also builds long-term, loyal customer relationships.

The challenges telcos have with SMBs

SMBs are not like large enterprises; they come with their own set of complexities that require a thoughtful and strategic approach. The SMB market is inherently volatile, with many businesses experiencing high failure rates.

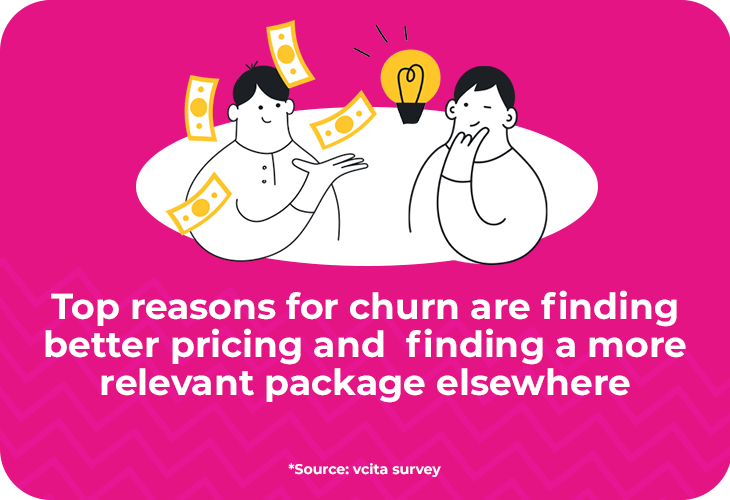

This unpredictability can lead to high churn rates—ranging from 8% to 12% depending on the service, according to the vcita survey—resulting in inconsistent revenue streams, making long-term planning and investment more challenging for telcos. Top reasons for churn among SMBs include finding better pricing (35%) and being able to attain the same services as part of a more relevant package (16%).

The latter shows us more than anything that SMBs are diverse, and while there is a lot of commonality within this market, businesses in different verticals may have varying needs. This diversity means that a one-size-fits-all approach doesn’t work. Since delivering unique solutions to satisfy different vertical needs is a challenge in itself, telcos should look for scalable and flexible tools and services that can adapt to different and evolving vertical requirements.

Moreover, small businesses often operate with constrained resources and limited technical expertise, particularly in IT and operations. This is only compounded by the high cost of technology and the overwhelming number of available services, requiring telcos to offer comprehensive, user-friendly solutions that simplify IT management.

Solutions to overcome SMB market challenges

Addressing the challenges faced by telcos in the SMB market requires a strategic, phased approach that focuses on customer engagement, brand loyalty, and the efficient cross-selling and upselling of services. Here’s how I believe telcos can turn these challenges into opportunities for growth:

1. Reframe the value proposition

Just as the telco’s network is a core asset with strategic importance and considerable investments, telcos should continue to invest in their customers–an important core asset by itself. By focusing investments on their own value proposition and positioning themselves as trusted advisors, telcos can combat low brand value, high churn, and pricing sensitivity. Prioritizing customer engagement and brand presence will create a foundation for stronger, more loyal and lasting relationships.

2. Offer interconnected solutions

The key to driving engagement and loyalty lies in offering a platform tailored to the SMB market that customers can easily adopt and use to run business operations. Instead of focusing on serving more and more disconnected tools and services in the hope of selling more, telcos need to deliver value through orchestrated and interconnected solutions.

On average, SMBs use 42 different apps to run their businesses according to the 2024 State of SaaSOps report by BetterCloud, leading to app fatigue and inefficiency. A unified platform that integrates third-party solutions under one umbrella can streamline workflows, enhance productivity, and simplify business operations for SMBs.

According to the vcita survey, SMBs expect their telcos to provide tools such as reporting and analytics (49%), business management tools (46.4%), and call center services (46%). By offering these in a unified, cohesive platform, telcos can reduce complexity, meet the specific needs of SMBs, and further solidify their brand value alongside growing customer loyalty.

3. Enhance customer engagement

A business management platform designed for SMBs should integrate communication channels, allowing small businesses to maintain client interactions seamlessly. This omnichannel experience ensures that SMBs can manage their customer relationships effectively, driving their own brand loyalty. By offering such a comprehensive solution, telcos provide significant value to SMBs, making the telco’s platform indispensable to the SMB’s daily operations. This consistent utility fosters engagement and makes SMBs more reliant on the telco’s services, ultimately strengthening the telco’s relationship with their SMB customers.

4. Drive brand loyalty

As SMBs use a business management platform on a daily basis to manage their daily operations, telcos have an opportunity to increase their brand presence and strengthen customer loyalty by delivering such a platform under their own brand. For example, if an SMB is using a virtual number integrated into a telco-branded platform, it is less likely to switch to a cheaper alternative. The value of the integrated solution outweighs the cost savings of standalone services, making the telco’s offering indispensable.

5. Acknowledge younger customers

The younger customer segment (25-34) presents a unique opportunity for telcos. According to our most recent survey, this demographic is the biggest spender on telco services, with expenditures ranging from $250-$500 per month, and has the highest ARPA. That being said, this age group is less likely to use internet services from traditional telcos. In order to capture the market, telcos should cater to the younger market’s early and widespread adoption of digitalization, offering more innovative offerings that meet their advanced digital needs and preferences.

6. Smart integration of services

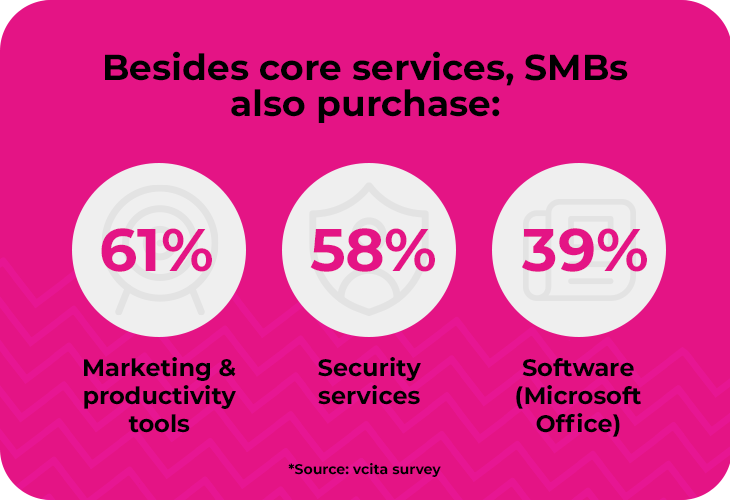

Telcos can further grow ARPA by leveraging a unified platform that integrates both organic and third-party services under one umbrella, allowing them to smartly incorporate their entire service portfolio. Beyond core internet and phone services, our survey indicates that 61% of SMBs also purchase marketing and productivity tools from telcos, 58% purchase security services, and 39% purchase software like Microsoft Office.

While SaaS marketplaces are often used to offer these additional services, they come with significant limitations. Since these marketplaces are not integrated into the customer’s business context, services are typically offered only during a telco-driven sales session or when a customer proactively searches for a specific service. This disconnect limits the discovery and consumption of new services, which restricts revenue potential.

To overcome this, telcos should offer these services as part of a comprehensive, customer-facing solution that is directly integrated into the SMB’s daily operations. This approach enhances engagement and enables contextual cross-selling and upselling.

For instance, when a new employee joins an SMB, the platform can automatically suggest relevant services like a virtual number or an additional user license for teleconference or UCaaS services. This seamless, contextual offering maximizes service utilization and generates additional revenue.

7. Provide tailored, scalable solutions

Telcos should focus on scalable solutions that cater to the diverse needs of SMBs without requiring tailored development for each customer. This approach ensures that small businesses receive the flexibility they need, while telcos can manage their service offerings efficiently. The platform needs to be extensible, allowing telcos to increase coverage and scope through plugins and add-ons. This adaptability helps telcos meet the varying requirements of SMBs across different verticals, providing a comprehensive and scalable solution that grows with the business.

Building loyalty and engagement through a scalable platform

The solution for telcos aiming to capture the full potential of the SMB market lies in adopting a scalable platform. The diverse and unique needs of SMBs make it impractical to tailor individual solutions for each business. Instead, a robust, all-encompassing platform that adjusts to vertical needs can address these varied requirements effectively and efficiently.

A scalable platform allows telcos to offer a comprehensive suite of services that SMBs can rely on daily. This not only streamlines their operations but also enhances their engagement with the telco’s offerings, helping telcos to become an indispensable part of their SMB customers’ daily workflows. This consistent interaction fosters brand loyalty, deepens customer relationships, and drives increased revenue and ARPA.

Moreover, such a platform positions telcos as trusted advisors. By leveraging operational data and contextually presenting relevant services to the right user at the right time, telcos can proactively meet SMBs’ needs. This approach transforms the telco-SMB relationship from a transactional one to a partnership based on trust and mutual growth, paving the way for better service utilization, deeper customer engagement, and higher brand value that leads to incremental revenue growth.

To get more insights from the vcita survey about the Telco-SMB relationship, click here.