Telcos are constantly striving to gain an edge, especially when it comes to serving small and medium-sized businesses (SMBs). Unlike large enterprises, SMBs have diverse needs, fluctuating budgets, and a heightened sensitivity to pricing and service quality. A one-size-fits-all approach just isn’t relevant for this audience; retaining SMB clients requires a deep understanding of their expectations and a strategic approach to meeting their evolving demands.

To shed light on the SMB market, we recently conducted a survey of 250 small business owners across the United States. Our goal was to uncover what SMBs truly want from their telco providers and how telcos can better position themselves as essential partners in the SMB journey. The results were telling—a mix of trust, high expectations, and a clear indication that telcos have the potential to play a much larger role in the success of their SMB clients.

In this blog, we’ll dive into the key findings from our survey, exploring the challenges telcos face in retaining SMB customers, the services SMBs value most, and how telcos can leverage these insights to enhance customer loyalty, reduce churn, and ultimately drive growth. By understanding and addressing the specific needs of the SMB market, telcos can not only retain their customers but also become indispensable to their business operations.

The challenges of retaining SMB customers

Retaining SMB customers is a significant challenge for telcos, primarily due to the diverse and evolving needs of these businesses. Unlike large enterprises, SMBs operate with tighter budgets and a heightened focus on cost-effectiveness, making them more prone to switching providers.

Our survey revealed high churn rates among SMBs, ranging between 8% and 12%, depending on the service. This turnover is especially pronounced in areas such as network security, internet access, and mobile phone plans—services that are critical to daily operations but often viewed as commoditized.

The results also highlight the top three reasons for this churn. The most common is better pricing, with 35% of SMBs switching providers to save on costs. This emphasizes the price sensitivity in this market, where even small savings can drive businesses to change providers. The second major reason, cited by 22% of respondents, is dissatisfaction with the level of service they received. SMBs expect not only competitive pricing but also high-quality, reliable service from their telcos.

Lastly, 16% of SMBs switched providers because they found a more relevant package elsewhere. This statistic is particularly telling, as it reveals that SMBs are increasingly looking for telcos that offer a diverse range of services beyond basic connectivity. They are seeking comprehensive solutions that address their broader business needs, from productivity tools to security services. For telcos, this means that merely offering competitive prices is not enough—success in the SMB market requires a strategy that combines value, service quality, and a diverse portfolio of offerings tailored to the specific needs of small businesses.

SMBs’ reliance on telcos for business success

SMBs rely heavily on their telco providers, not just for basic connectivity but as key partners in their overall business success. The financial commitment SMBs make towards their telco services is substantial, with nearly 50% of SMBs spending over $500 per month on telco services.

Notably, this goes toward more than just basic services; 90% of SMBs allocate part of their telco budget to productivity tools provided by their telco, demonstrating a clear preference for integrated solutions. Among the most popular services are marketing and productivity tools (61%), security services such as network security and antivirus (58%), and essential software like Microsoft Office (39%). This inclination towards consolidation presents a significant opportunity for telcos to position themselves as comprehensive service providers, offering a range of tools and services that cater to the diverse needs of SMBs.

SMBs have high expectations from telco providers

As small businesses navigate the complexities of a competitive market, they increasingly expect their telcos to offer solutions that go beyond traditional services. This desire for partnership is reflected in the additional services SMBs now expect from their providers.

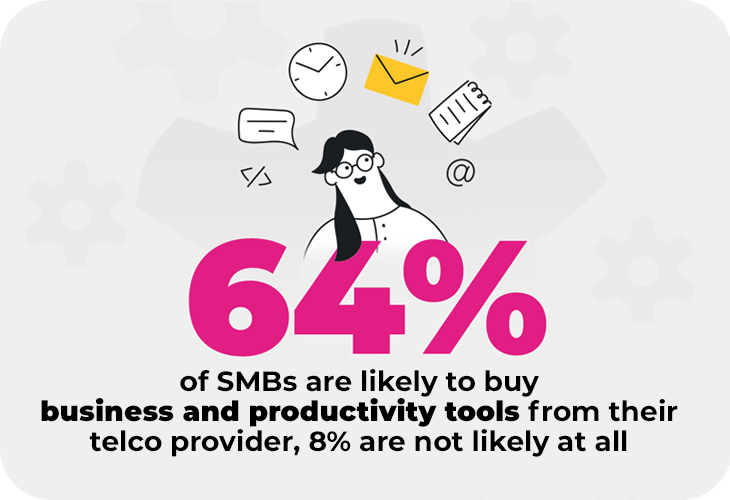

According to our survey, SMBs are particularly interested in three key service areas. Nearly half (49%) of SMBs indicated that they expect their telco to provide reporting and analytics tools, which can help them make data-driven decisions and optimize their operations. Forty six percent of SMBs are looking for business tools such as CRM systems, scheduling, and project management software—essential tools that streamline their workflows and improve productivity. Financial apps, including payments, invoicing, and accounting solutions, are also in high demand, with 38% of SMBs expecting their telco to offer these services.

This broad expectation for business and productivity tools underscores the trust that SMBs place in their telco providers. In fact, 64% of SMBs are likely to purchase such tools from their telco, demonstrating a strong belief in the ability of these providers to meet their diverse needs. For telcos, this presents a significant opportunity to deepen customer relationships by expanding their service offerings and positioning themselves as indispensable partners in the SMBs’ growth and success.

Understanding SMB decision-making

SMBs operate in fast-paced environments where efficiency and cost-effectiveness are paramount. As a result, their choices in telco services are driven by a need to optimize operations while keeping expenses in check.

One significant challenge SMBs face is “app fatigue.” The average small business uses 42 different apps daily to manage various aspects of their operations, according to the 2024 BetterCloud State of SaaSOps report. As noted in Amir Blich’s article, this overwhelming number of tools can lead to inefficiencies, wasted time, and frustration. Consequently, there is a growing demand among SMBs for integrated solutions that can consolidate multiple functions into a single platform, simplifying their workflows and reducing the burden of managing disparate systems.

This demand for consolidation is reflected in the fact that 36% of SMBs have switched telco providers in the past year specifically to find better CRM and payment solutions. SMBs are not just looking for basic connectivity—they want telcos that can offer comprehensive, integrated services that align with their business needs.

When choosing a telco provider, the top considerations for SMBs include price (25%), ease of integration (18%), and the availability of additional relevant services like CRMs (14%). These priorities highlight the importance of offering cost-effective solutions that are easy to implement and come bundled with value-added services.

How can telcos unlock the full potential of the SMB market?

The insights from our recent survey of SMBs reveal a clear narrative: small and medium-sized businesses rely heavily on their telco providers, not just for connectivity, but as crucial partners in their ongoing success. However, retaining these customers is no easy task, given their diverse needs and the high churn rates that characterize the SMB market. To succeed, telcos must move beyond traditional service offerings and focus on truly understanding and meeting the unique demands of their SMB clients.

To effectively retain SMB customers, telcos should implement a comprehensive, integrated platform that goes beyond basic connectivity to include the services SMBs value most. By bundling essential tools such as reporting and analytics, business management, and financial apps, telcos can offer SMBs the convenience of consolidating multiple services under one roof. This approach not only reduces the app fatigue that plagues many small businesses but also positions the telco as an indispensable partner in their daily operations.

To get the full insights from the survey, download our SMB-telco relationship infographic here.